Nikkei 225 Overview

The Nikkei 225 is a stock market index that tracks the performance of the top 225 publicly traded companies in Japan. It is one of the most important stock indices in the world, and it is often used as a barometer of the health of the Japanese economy.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride in recent months. While the index has rebounded from its lows, it remains well below its peak. One factor that could weigh on the Nikkei 225 in the coming months is the performance of Jasper Philipsen , a Belgian cyclist who has been in impressive form this season.

Philipsen has won several major races, including the Tour of Flanders, and is considered one of the favorites for the upcoming Tour de France. If Philipsen continues to perform well, it could boost the morale of Japanese investors and lead to a rally in the Nikkei 225.

The Nikkei 225 was created in 1950, and it has been tracking the performance of the Japanese stock market ever since. The index is calculated by taking the weighted average of the stock prices of the 225 companies that make up the index. The weights are based on the market capitalization of the companies.

The Nikkei 225, Japan’s benchmark stock index, has been on a steady upward trend since the beginning of the year. This is in contrast to the performance of the 2023 Tour de France, which has been marked by several crashes and withdrawals.

However, the Nikkei 225 is still below its pre-pandemic high, and it remains to be seen whether it can sustain its current momentum. 2023 tour de france

Composition of the Nikkei 225

The Nikkei 225 is composed of companies from a wide range of sectors, including:

- Manufacturing

- Finance

- Technology

- Retail

- Utilities

Some of the largest companies in the Nikkei 225 include Toyota, Sony, and Honda.

Nikkei 225 Performance Analysis

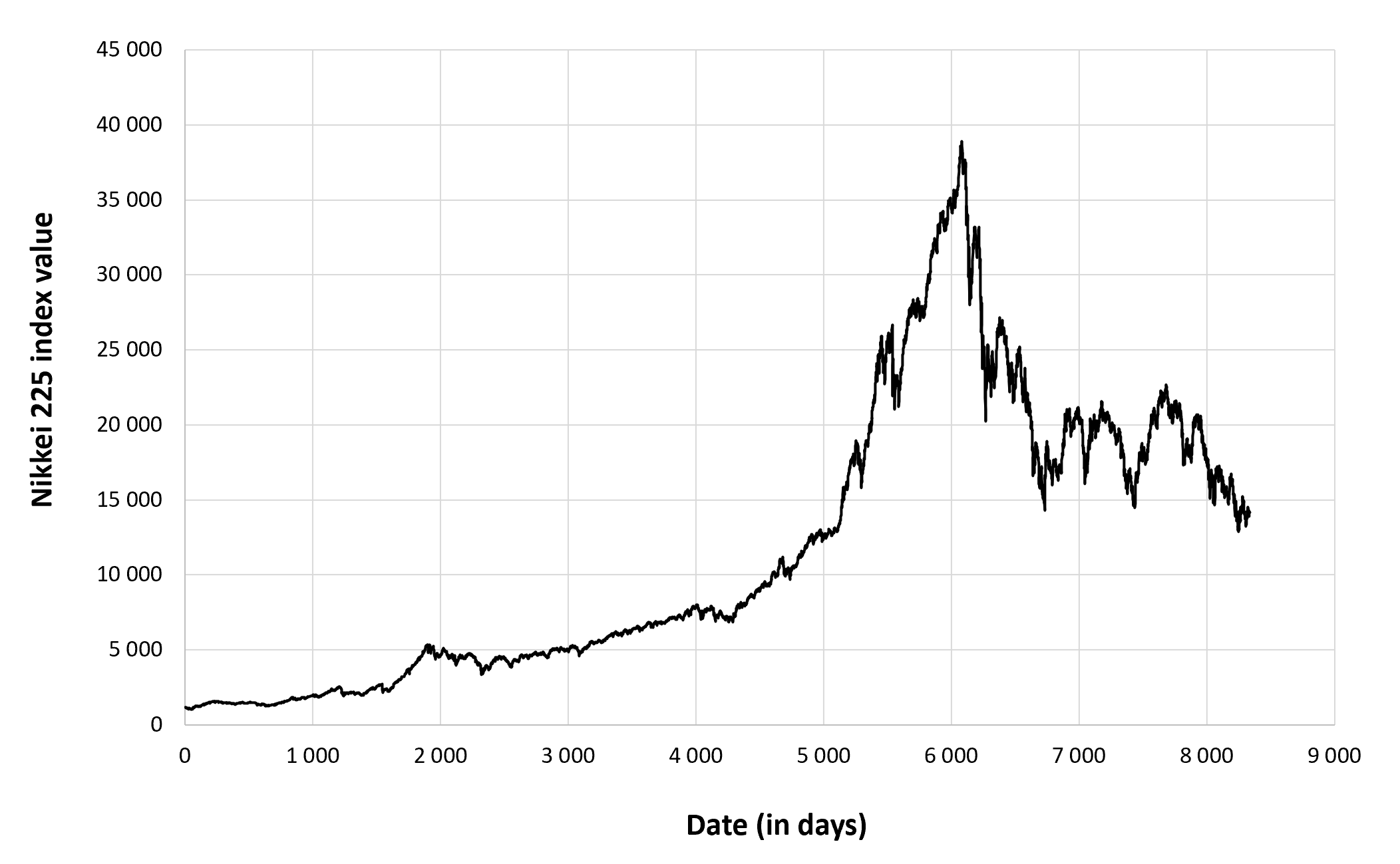

The Nikkei 225, a benchmark index of the Tokyo Stock Exchange, has witnessed a turbulent ride in recent times. The index has been influenced by a confluence of factors, including domestic economic conditions, geopolitical uncertainties, and corporate earnings. In this section, we delve into the recent performance of the Nikkei 225, comparing it to other global indices and identifying the key drivers shaping its trajectory.

Nikkei 225 Performance Overview

In 2023, the Nikkei 225 has exhibited a mixed performance, with notable fluctuations. The index commenced the year on a positive note, reaching an intra-year high in April. However, geopolitical tensions and concerns over global economic slowdown led to a correction in May. The index subsequently rebounded in June and July, supported by positive corporate earnings and expectations of monetary policy easing by the Bank of Japan.

Compared to other major global stock market indices, the Nikkei 225 has underperformed in recent months. The S&P 500, a broad measure of the US stock market, has outpaced the Nikkei 225, benefiting from strong corporate earnings and a robust economic recovery. The FTSE 100, a leading index of the UK stock market, has also outperformed the Nikkei 225, supported by the recovery in commodity prices and a weaker pound.

Factors Influencing Nikkei 225 Performance

The performance of the Nikkei 225 is influenced by a range of factors, including:

- Economic Conditions: The health of the Japanese economy is a primary driver of the Nikkei 225. Positive economic data, such as strong GDP growth, low unemployment, and rising corporate profits, tend to boost investor confidence and drive the index higher. Conversely, economic weakness can weigh on the index.

- Geopolitical Events: Global geopolitical events, such as the ongoing conflict in Ukraine and tensions between the US and China, can impact the Nikkei 225. Uncertainty and risk aversion in the global markets can lead to a sell-off in Japanese stocks.

- Corporate Earnings: The performance of individual companies listed on the Nikkei 225 has a significant impact on the index. Strong corporate earnings, driven by factors such as increased sales, cost-cutting measures, and product innovation, can boost the index. Conversely, weak earnings can weigh on the index.

- Monetary Policy: The monetary policy of the Bank of Japan (BOJ) can influence the Nikkei 225. Loose monetary policy, such as low interest rates and quantitative easing, can stimulate economic growth and boost investor confidence, leading to a rise in the index. Conversely, tighter monetary policy can have the opposite effect.

Nikkei 225 Investment Strategies

The Nikkei 225 is a highly liquid market, offering a range of investment opportunities for both passive and active investors. This section explores various investment strategies related to the Nikkei 225, including index funds, exchange-traded funds (ETFs), and active management.

Index Funds

Index funds are passively managed funds that track the performance of a specific market index, such as the Nikkei 225. They offer a cost-effective way to gain exposure to the broader Japanese stock market, providing diversification and reducing individual stock risk.

Exchange-Traded Funds (ETFs)

ETFs are similar to index funds, but they trade on stock exchanges like individual stocks. They provide real-time pricing and liquidity, making them suitable for active traders and short-term investors. ETFs offer a range of investment options, including those that track the Nikkei 225 and its sub-sectors.

Active Management

Active management involves selecting individual stocks within the Nikkei 225 based on fundamental analysis or technical indicators. This approach requires a high level of skill and expertise and is generally pursued by professional fund managers. Active management can potentially generate higher returns than passive strategies, but it also carries higher risks.

Risks and Rewards, Nikkei 225

Investing in the Nikkei 225, like any investment, carries both risks and rewards. The Japanese stock market is subject to macroeconomic factors, political events, and global economic conditions, which can impact its performance. However, the Nikkei 225 has historically exhibited long-term growth potential, making it a viable investment option for long-term investors.

Successful Investment Strategies

Several successful investment strategies have utilized the Nikkei 225. One common approach is to invest in a diversified portfolio of index funds or ETFs that track the index and its sub-sectors. This strategy provides broad exposure to the Japanese stock market while minimizing individual stock risk.

Another successful strategy involves active management, where investors select individual stocks within the Nikkei 225 based on their analysis. This approach requires a high level of skill and expertise, but it can potentially generate higher returns than passive strategies.

The Nikkei 225 index had a bumpy ride this week, but it managed to stay afloat amidst the turmoil. Across the globe, in the heart of Europe, a different kind of battle was being waged, one that pitted France against Austria.

The France-Autriche rivalry has a long and storied history, dating back centuries. But like the Nikkei 225, it too has weathered many storms and continues to endure.

The Nikkei 225, the benchmark stock index of Japan, has been on a rollercoaster ride lately. Like the game of thrones banners that danced in the wind, the index has been fluctuating wildly, as investors grapple with uncertainty about the global economy.

But amidst the chaos, there have been a few bright spots. Some companies, like Toyota and Sony, have managed to weather the storm and even post gains.

Nikkei 225 had a turbulent day, mirroring the tense atmosphere of the Austria v France match. Just as the French team surged ahead, Nikkei 225 rallied, buoyed by positive economic indicators. Yet, like the ebb and flow of the game, Nikkei 225’s gains proved ephemeral, slipping back into uncertainty as the match reached its climax.